pros and cons list carbon tax

Both cap-and-trade programs and carbon taxes can work well as long as they are designed to provide a strong economic signal to switch to cleaner energy. By imposing a tax you are making a.

Carbon Tax What Are The Pros And Cons Climateaction

He suggests that this should be given 100 as a dividend to the general public stating that the family with carbon footprint less than average makes money their dividend exceeds their tax.

. The tax rate on carbon products should be attaches to objective CO2 tonnage contributed to the atmosphere. List of Cons of Carbon Tax. An argument made by business is that carbon taxes will discourage investment and reduce profitability.

Corporations Can Relocate If a company is charged for the production of carbon dioxide in an area and isnt charged in the other area than the corporation is going to move to the second area. A carbon tax can be very simple. The carbon tax is the most equitable method for carbon use to pay for its pollution.

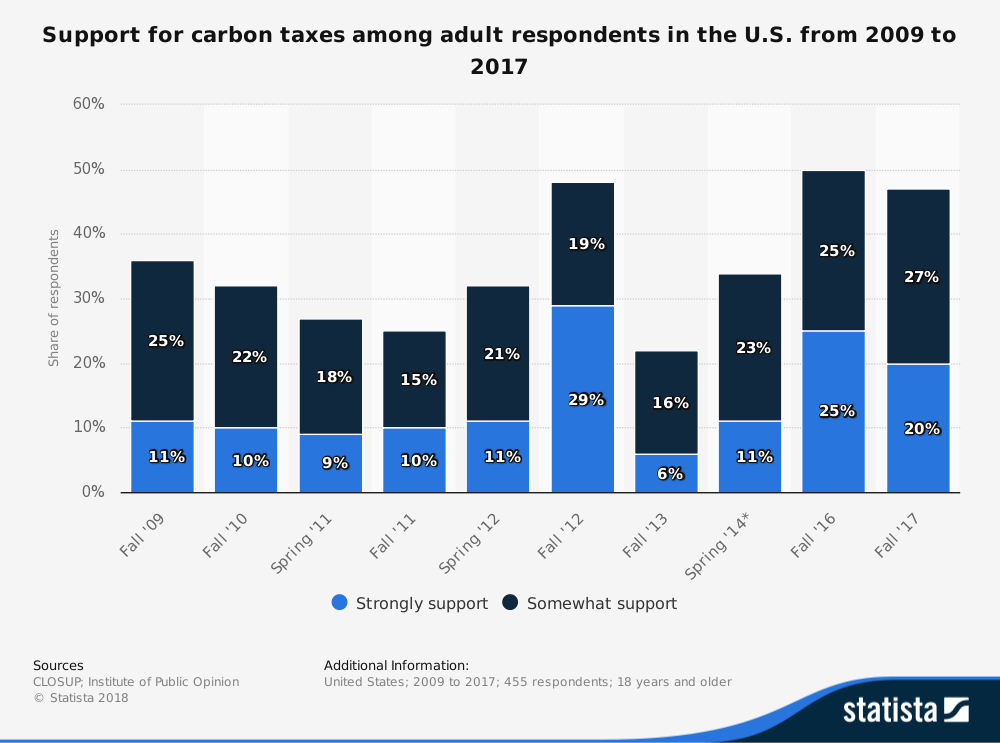

It encourages people to find alternative. This would result in tax revenue of 670 billion. In relation to the US Hansen argues that we could set a carbon tax at US115 per ton of CO2.

The system needs to be employed by law similar to other sin taxes on alcohol tobaccos and even sales taxes. At a high level the primary advantage is the carbon tax will force companies to find alternative methods in their manufacturing processes by levying a tax that increases their cost. A carbon tax also has one key advantage.

List of Pros of Carbon Tax. CO2 taxes often apply when triggering thresholds get reached through mining production or fabrications activities. However some differences exist.

The carbon tax creates an artificial economic market that isnt always sustainable. Pros and Cons of Carbon Tax. It is easier and quicker for governments to implement.

Countries may free ride on others making efforts to reduce carbon emissions and reduce the impact of global warming. Up to 24 cash back Withal the positive intentions that this type of tax carries its idea still has garnered some criticisms leading to some heated debates around the world. Answer 1 of 12.

The costs of pollution should be paid by the polluters not by society at large. If you give a company or an individual a free hand and dont put any financial burden or accountability then the individual or company will go all guns blazing damaging the environment in the process. Good for the Environment.

Of course the tax is proposed to increase steadily but how much per year is not stated. For example under President Trump the US left the Paris agreement on global warming. List of Advantages of Carbon Tax 1.

Thus we tax gasoline and diesel fuel to. If the carbon tax grows let us say by 20ton annually thus to. Carbon tax makes companies more responsible.

If the policy were to be enacted a large percentage of a countrys carbon emissions will be monitored and sanctioned. Unfortunately this would also create a major disadvantage as the carbon tax will most likely hurt. This is the principle of the Pigovian tax on externalities of all kinds put forward by economist Arthur Pigou in 1920.

The opponents to the policy believe that it is impossible to guarantee that such a policy could be easy to enact making it an. For example a carbon tax could cover 98 of the US carbon dioxide emissions. To come up with a good opinion about this subject matter on our end it is best to look at its pros and cons.

There are quite a few pros and cons that need to be discussed. This will damage the economy of the first area and on top of that it is going to create a loss of jobs. Many of the new carbon tax proposals use an emissions trading system as a primary form of income generation.

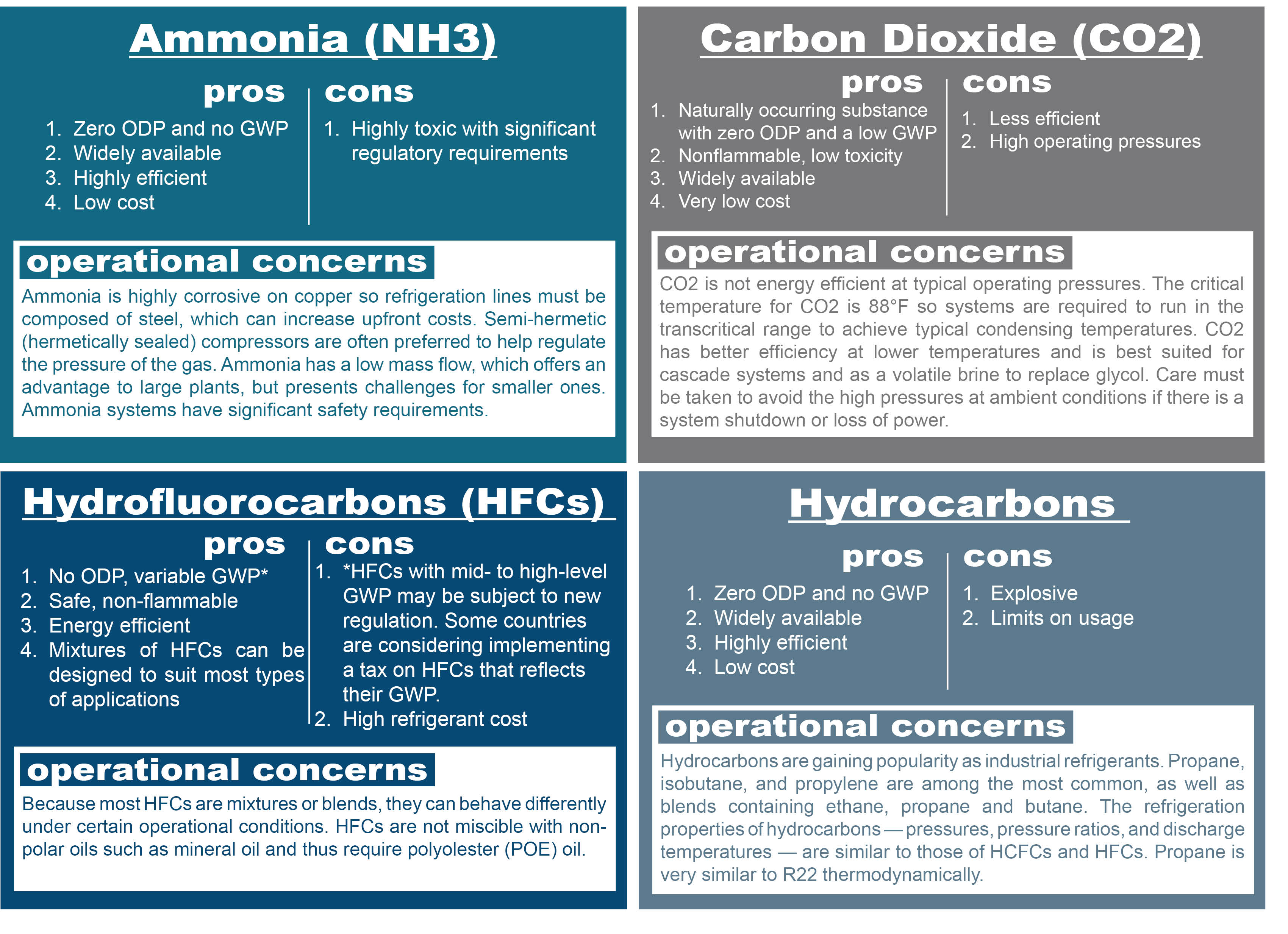

Industrial Refrigerants Selection Guide From Stellar Stellar Food For Thought

Carbon Tax Pros And Cons Economics Help

28 Crucial Pros Cons Of Carbon Offsetting E C

Carbon Tax Pros And Cons Economics Help

14 Advantages And Disadvantages Of Carbon Tax Vittana Org

Carbon Tax Pros And Cons Economics Help

18 Advantages And Disadvantages Of The Carbon Tax Futureofworking Com

Carbon Tax Pros And Cons Economics Help

Carbon Tax What Are The Pros And Cons Climateaction

Carbon Tax Pros And Cons Economics Help

Advantages And Disadvantages Of Multiple And Single Sourcing Strategy Download Table

27 Main Pros Cons Of Carbon Taxes E C

27 Main Pros Cons Of Carbon Taxes E C

Pros And Cons Of Each Regional Economic Model Type For Estimating Download Scientific Diagram

14 Advantages And Disadvantages Of Carbon Tax Vittana Org

Pros And Cons Of Each Regional Economic Model Type For Estimating Download Scientific Diagram

27 Main Pros Cons Of Carbon Taxes E C